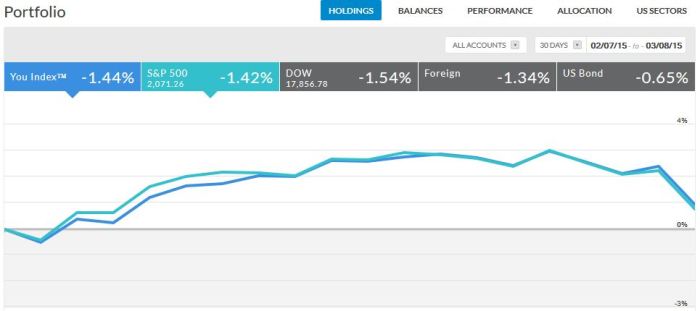

On Friday, March 6 the market took a dive, and every one of my stocks and mutual funds decreased in value. While I watch how the market does on a daily basis, I try not to let my emotions take hold and make drastic changes. But it reminds me about focusing on diversification across my investments.

Investment Plan Changes

When I started 2015, I had a goal to invest an average of $1,000 per month into my brokerage account, max out my Roth IRA, and continue my standard 6% base pay contributions to my 401(k). This will equate to a total of about $23,000 this year, before the company match in 401(k). There’s always going to be some volatility in the market, and I’m well aware that it’s impossible to time the market. This is just a reminder to myself that I should be focused not on when to invest, but what to invest in.

Asset Mix Changes

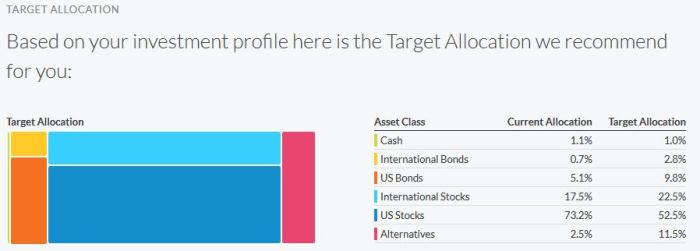

I have an aggressive allocation investment strategy. For evaluating my investment allocations, I use PersonalCapital.com.

Here’s how the brokerage account is looking:

Looks like I’m well diversified and pretty close to target allocation. My next $1000 will likely go to US stocks.

Here’s Roth IRA:

Not good. I’ve got some work to do in a number of areas. My next $500 contribution will likely go to International stocks and US bonds.

And finally, 401(k):

Yes, this is the worst of them all. Since I don’t have any investments in International stocks, I expect to start contributing 100% of future investments towards them until things become more balanced. Right now, basically everything’s in US stocks.