Update for March 2015:

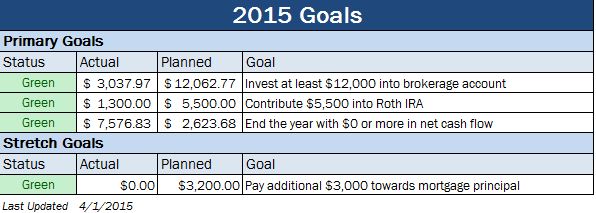

Brokerage Investment Goal:

- March Investments contributions were $1,075.20

- YTD Investments contributions are at $3,037.97

- Outlook: Green – everything’s on track.

Roth IRA Investments Goal:

- March Investments were $500

- YTD Investments total $1,300

- Outlook: Green – everything’s on track.

Cash Flow Goal:

- March was cash flow positive, with $5,809.63 being added to the bank accounts

- YTD is at a positive $7,576.83 net cash flow

- Outlook: Green – due to awesome bonus and base pay increases that exceeded my original estimate.

Additional Mortgage Principal Stretch Goal:

- March was $0

- YTD is $0

- Outlook: Green. I anticipate making my first principal-only payment of the year of $1,700 in April. Sometime later in the year will add another $1,500 to bring the total estimated to $3,200.

Keep track of the progress over at the 2015 goals page.