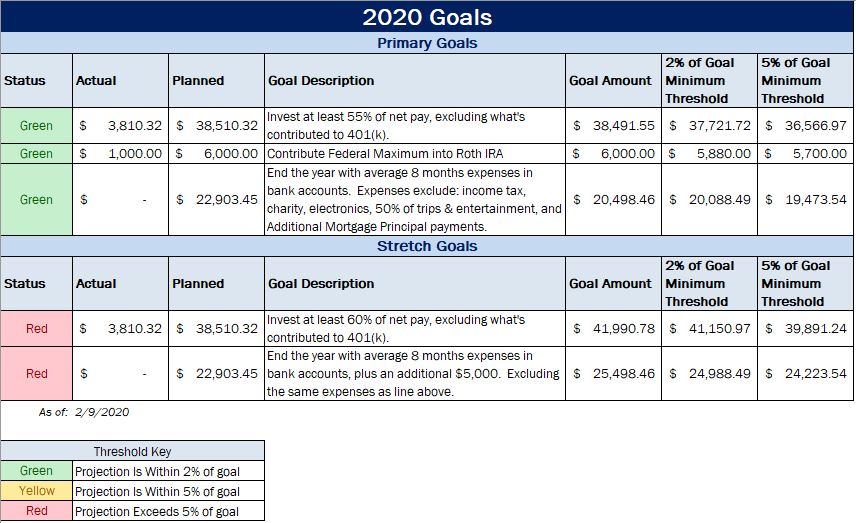

Invest at least 55% of net pay, excluding what’s contributed to 401(k):

- Ensures I’m investing at least 55% of my net take-home pay into some kind of investment.

- Investments that count towards this goal are Roth IRAs and Taxable Brokerages.

- 401k contributions are not included, as they are taken out of my paycheck.

Contribute Federal Maximum into Roth IRA:

- This ensures I’m contributing the federal maximum allowed towards a Roth IRA.

- For 2020, the maximum contribution is $6,000.

End the year with average 8 months expenses in bank accounts:

- Ensures an emergency fund exists for unexpected events.

- Calculates minimum required emergency fund by adding up all expenses for 2020, divides by 12, then multiplied by 8 to get average expenses.

- Some expenses are excluded or reduced as they would likely not be incurred in an emergency scenario (charity contributions, trips / entertainment, and electronics).

Stretch Goals:

- A more aggressive version of the “primary goals”.

How Results are Calculated:

- Green: No worries at this time meeting the goal, based on actual and planned metrics. Or, goal is within 2% of target.

- Yellow: Some worry about achieving the goal, planned budget shows goal will not be met. Or, amount projected is within 5% of target.

- Red: Goal is at risk for being met. Planned budget shows major changes needed for goal to be met. Or, amount projected is less than 5% of target.