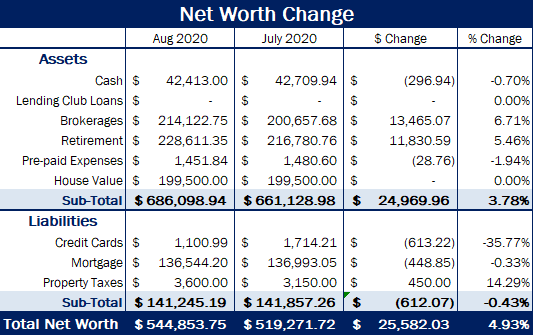

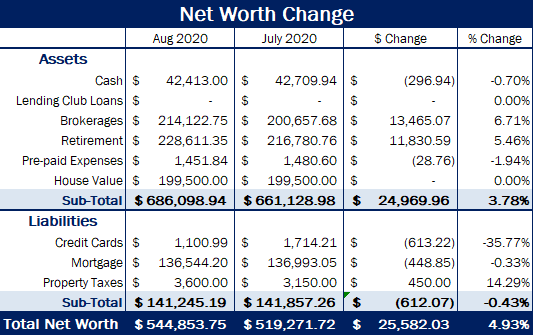

In August, net worth increased for the 4th straight month, mostly due to stock market gains. Net worth went up by 4.93% to end at $544,853, an increase of about $25,500.

See the Net Worth Tracker page for a history of my net worth.

In August, net worth increased for the 4th straight month, mostly due to stock market gains. Net worth went up by 4.93% to end at $544,853, an increase of about $25,500.

See the Net Worth Tracker page for a history of my net worth.

With rates at record lows, it may be time to refinance your mortgage – even if you recently closed on a new mortgage or just refinanced. I bought my house in 2012 when I thought rates “couldn’t get any lower”, little did I know a pandemic would hit the world and rates would fall off a cliff.

Though a local credit union I’m able to lock in a 15 year fixed rate of 2.65%, saving over 1% from my current 3.875% fixed rate.

| Old Mortgage | New Mortgage | Difference | |

| Principal Balance | $136,993.05 | $131,000 | $5,993.05 |

| Interest (fixed) | 3.875% | 2.65% | -1.225% |

| Payment Breakdown 1 month for comparison | $448.85 (p) $442.37 (i) $891.22 (t) | $593.48 (p) $289.29 (i) $882.77 (t) | $144.63 (p) -$153.08 (i) -$8.45 (t) |

| Remaining Years | 18 | 15 | -3 |

This means:

I need to put about $6,000 in extra principal during the refinancing process to make these numbers work. But…

For me, the pros outweigh the only con of dropping $6k in principal. And technically that just further reduces the debt and is not an actual “expense” on the financial statement.

In this post I will go into more details behind my income and expenses to show one of the contributing factors to the growth of my net worth every month. Hint: it’s not ONLY because of how the stock market performs!

To start, I make a pretty high salary (about $115,000 / year) which means after taxes I net about $6620 per month. Here’s my expense breakdown:

| Category | Amount | Remaining |

| Starting Amount | $6,620 | |

| Discretionary Expenses | $1,100 | $5,520 |

| House Mortgage, Taxes, Insurance & Maintenance | $1,400 | $4,120 |

As you can see, on an average month after all my basic expenses, insurance, lifestyle costs, etc. I have about $4,100 remaining. Everything from this point adds to net worth because the remaining money either goes to bank accounts or gets invested. (Note: when I say I “net” $6,620 I’m not including 401K contributions, even though technically I never see the money hit the bank account.)

Here’s the breakdown of where the money gets invested:

| Category | Amount |

| Roth 401(k) | $582 |

| Roth IRA | $500 |

| Taxable Brokerage | $3,000 |

If the stock market was flat for an entire month, my net worth would grow about $4,100 because my expenses are less than half of my net income (about 40%).

This is one of the reasons attention should be paid to not spending everything you make, since the remainder adds to your net worth, and ultimately your financial freedom.