I’m a little late getting my goals posted. I’ve had them formed since Q1 2021 but I’ve been tweaking them since and I am finally ready to settle on my commitments for the year.

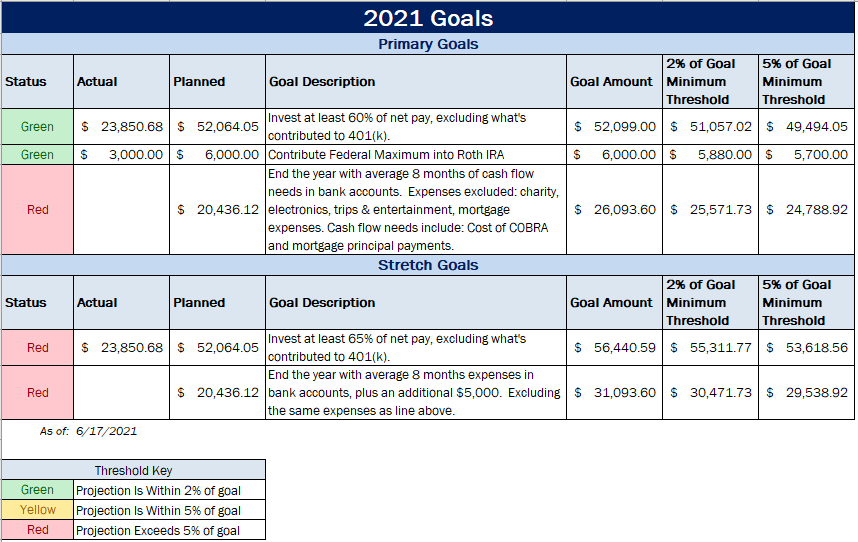

Primary Goals

Invest at least 60% of net pay, excluding what’s contributed to 401(k)

- Increased from 55% in 2020 to:

- Make up for a reduction in 401(k) employer match that was 6% of my contribution

- Keep me focused on investing more each year

- Represents any investments I make that are not toward my 401(k) because technically net pay already assumes 401(k) is contributed

Contribute Federal Maximum into Roth IRA

- Ensures I’m keeping up with the maximum Roth IRA Contributions that I can make under Federal law

End the year with average 8 months of cash flow needs in bank accounts

- Provides expected cash needs in case of a an emergency, such as a sudden job loss

- Tries to represent a true cash flow need (which includes or excludes certain accounts)

- This is projected to not be met due to a relatively high cash burn expected through the remainder of 2021. See below for an explanation.

Stretch Goals

Invest at least 65% of net pay, excluding what’s contributed to 401(k)

- An even bigger stretch than the equivalent primary goal

End the year with average 8 months of cash flow needs in bank accounts, plus an additional $5,000

- Tries to ensure excess capital is saved (unless invested) as opposed to spent

Why the “average 8 months of cash flow needs in bank accounts” goal is at risk

- Trips / Entertainment expenses are looking to be $5,000 more than planned due to a major trip taken in June

- I accidentally made a pre-payment towards the mortgage of $450 instead of contributing it toward the payment due.

What I’m doing to correct the issue

- Food expenses was approximately 2 times higher than plan so far this year. This was primarily due to eating out more vs. eating at home. I plan to make more food at home to keep this within budget.

- Trips / Entertainment in June was unplanned in the budget and as a result was the primary contributor to putting my cash position at risk. I don’t expect to do this again, and future Trips / Entertainment expenses will be carefully scrutinized to hopefully reduce future projected expenses.