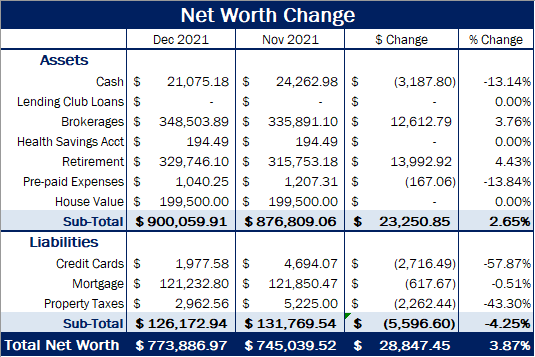

2021 ended with 2 goals met and 1 goal missed. I met targets for investing at least 60% of net pay and maximizing the Roth IRA contributions. I missed the cash in the bank target of $28,000, having only about $21,000.

The bank account goal was missed due to significant cash flows going to unplanned expenses. Even when the goals was set out in early 2021, having $28,000 in the bank was already at risk. Along the year, a few expenses went beyond their planned amount by a total of about $7,000: car maintenance, trips / entertainment, and pet expenses. These, along with few expenses that went under budget and not enough income to offset the increase contributed to a wider than expected reduction in bank accounts.

Head over to the 2021 goals page to get details on each of the goals.