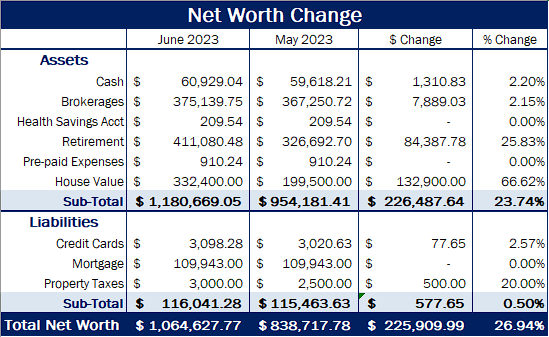

After many years of tracking, I’m finally able to consider myself a millionaire!

You may notice a couple of things stand out that have pushed my over the million dollar threshold:

- House Value went up $132,000

- Retirement Accounts went up $85,000

This month I looked through all my financials, including those that I knew that I under-reported asset valuations and a cash-balance pension plan, and asked myself: “What am I really worth if I was being honest with myself.” So I crunched the actual numbers and as you can see, I was under reporting over a quarter million dollars of value – pushing me over the $1,000,000 net worth threshold!

Some back story why I’ve historically under reported some assets

First, I’m typically extremely conservative in reporting assets. For my house, I always represented the original purchase price as what it was currently worth, knowing full well it had appreciated significantly since I bought it in 2012 (back when it was a buyer’s market!) I figured the excess in value would be partially offset by expenses incurred to sell it. Further, does it really matter what the valuation of the house is if I will always need a place to live? Meaning if I sold it, I would have to put that money towards someplace else to live, so if I had to take all the earnings and put it towards a down payment of the next house, does it really matter what it’s worth since I’ll never actually be able to do anything else with the cash it earned me?

Second, I’ve had a cash balance pension plan from my employer for quite a few years. In the early days it was worth so little that it didn’t make sense for me to go through the trouble of reporting it as it changed every month. Also, I don’t feel it’s really my money since it’s just what my employer says I should get when I eventually retire. For some reason when I hear those things my mind immediately goes to “don’t assume it’ll be there for you when you need it” – very similar to Social Security earnings. The result of this was an account that existed but not represented in any reports.

So why am I reporting it now?

I was reading an article from one of the Financial Independence / Retire Early (FIRE) blogs I follow – this post in particular – and in the article he talks about a couple of case studies of people who had money and were being super conservative with determining if they could retire. As he was talking about Dave, I saw several parallels between Dave’s line of thinking and my own. Sure, his financial life is different (for example, he has rental properties where I do not), but this quote was what really resonated with me:

“Yeah, I know”, he says, “But I’m just holding on for one more year, just to pad the accounts a bit further. What if the Airbnb slows down? What if my rental houses experience some vacancy? What if I want to help my nephew with college ten years down the line?”

This was exactly how I treated my financials. My version of “one more year of padding…” was hiding entire accounts from my financial reporting to give me the “padding” I desired.

But now I can’t hide it anymore

After I ran the numbers, I realized my padding had become too big to ignore – almost a quarter million dollars too big – so I will now begin reporting those accounts with relative accuracy. Will I still pad things? Yes. For example, the house’s value is not an exact science, it’s an estimate, so I will always round down to give it just a few thousand more of padding. There’s also another small ($6,600 / year small) pension that I’m expected to also receive from my employer. But it comes with a bunch of assumptions about how much I can really expect to receive, and it’s so little compared to other sources of income that it’s basically a rounding error anyway. (I also don’t know how to track something that’s expected to pay me monthly but only in retirement). You’ll also still not see any Social Security numbers here, again because I feel it’s largely outside my control so I don’t want to rely on it.

As always, see the Net Worth Tracker page for a history of my net worth.