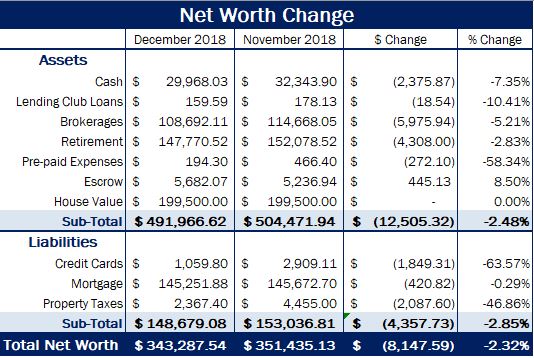

Net Worth

At the conclusion of 2018, net worth went down the month of December to end at $343,287.54, a 2.32% decline from November. This is primarily due to stock market volatility.

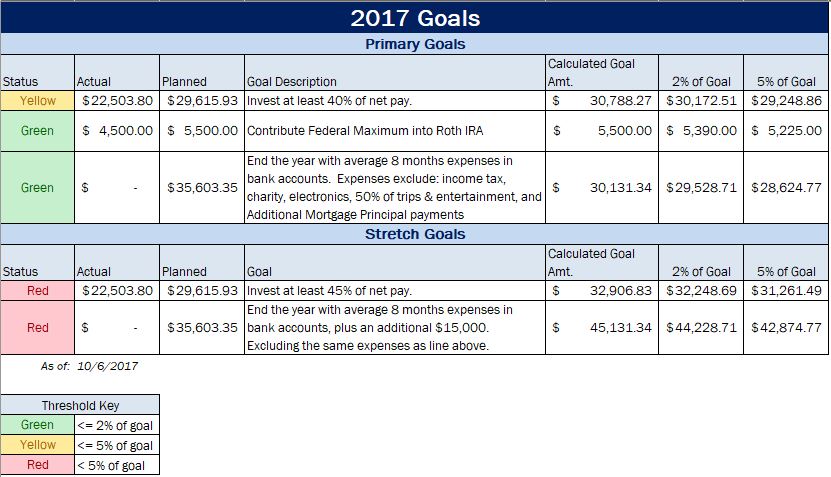

Goals

All primary goals were met as planned, which represent over $42,000 getting invested outside of my 401(k) – which includes taxable brokerages and Roth IRA. I was also able to do this while maintaining a minimum 8 month emergency fund.

Summary

Overall I’m very satisfied with how 2018 went. I’m not happy with the extreme amount of market volatility to end the year, but it’s something I can’t control. I am, however, satisfied to have achieved the following psychological milestones:

- Total value of over $100,000 in personal brokerages

- Maintained close to $30,000 in bank account

- Net worth increased over $36,000 from the end of 2017, which shows constant investing will pay dividends over the long-term

- Taxable brokerage dividend income was over $2,200, an increase of $885 from 2017