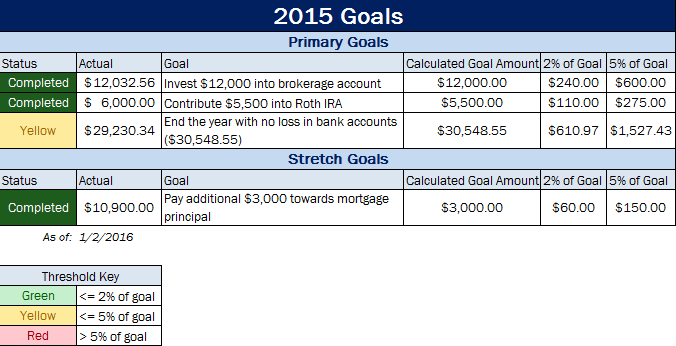

2016 has officially come to a close, and it’s time to review my goals to determine where I ended the year. In summary: all primary goals were met, and 1 of 2 stretch goals were met. The screenshot below shows the actual results (click to enlarge):

Primary Goals

Brokerage and LendingClub goal: This one was relatively easy to meet, especially since I was very consistent about investing the same amount every month. In any given month, I put aside $1250 to $1300, plus any dividends automatically was re-invested to count towards the goal. This gets offset by LendingClub loan payments, since any principal received technically deducts from the tally. Any interest received, however, counted towards the goal amount.

Contribute federal maximum to Roth IRA: Like Brokerage, this was also easily attained by simply investing the same amount every month.

8 Months emergency fund: This one was a little more difficult to determine what “8 month emergency fund” meant, since it’s completely dependent upon the actual spend in some expense categories. This is all the more reason to keep to a budget, since overages end up requiring more money in the emergency fund to compensate. But since I saved a lot of cash, this ended up not being at risk for most of the year.

Stretch Goals

Invest at least $20,000 into Brokerage / LC: I sort of lost track of this near the end of the year when I realized I would have excess cash. Had I spent more of my cash on this goal, it would have meant all stretch goals would have been met.

8 Months emergency fund + $5000: Since my expenses did not come in as much as I planned, this goal was met by a wide margin. As stated above, I could have taken the excess from this goal to make sure I met all stretch goals, but 4 out of 5 overall isn’t bad and it’s more than I expected to meet.

I expect to make up my 2017 goals by end of March, after I learn from 2016 and think about what’s going to happen in 2017.